TL:DR I made a site called InflationChart.com to see if stock markets actually grew when you discount for inflation by the Fed printing record amounts of money from thin air.

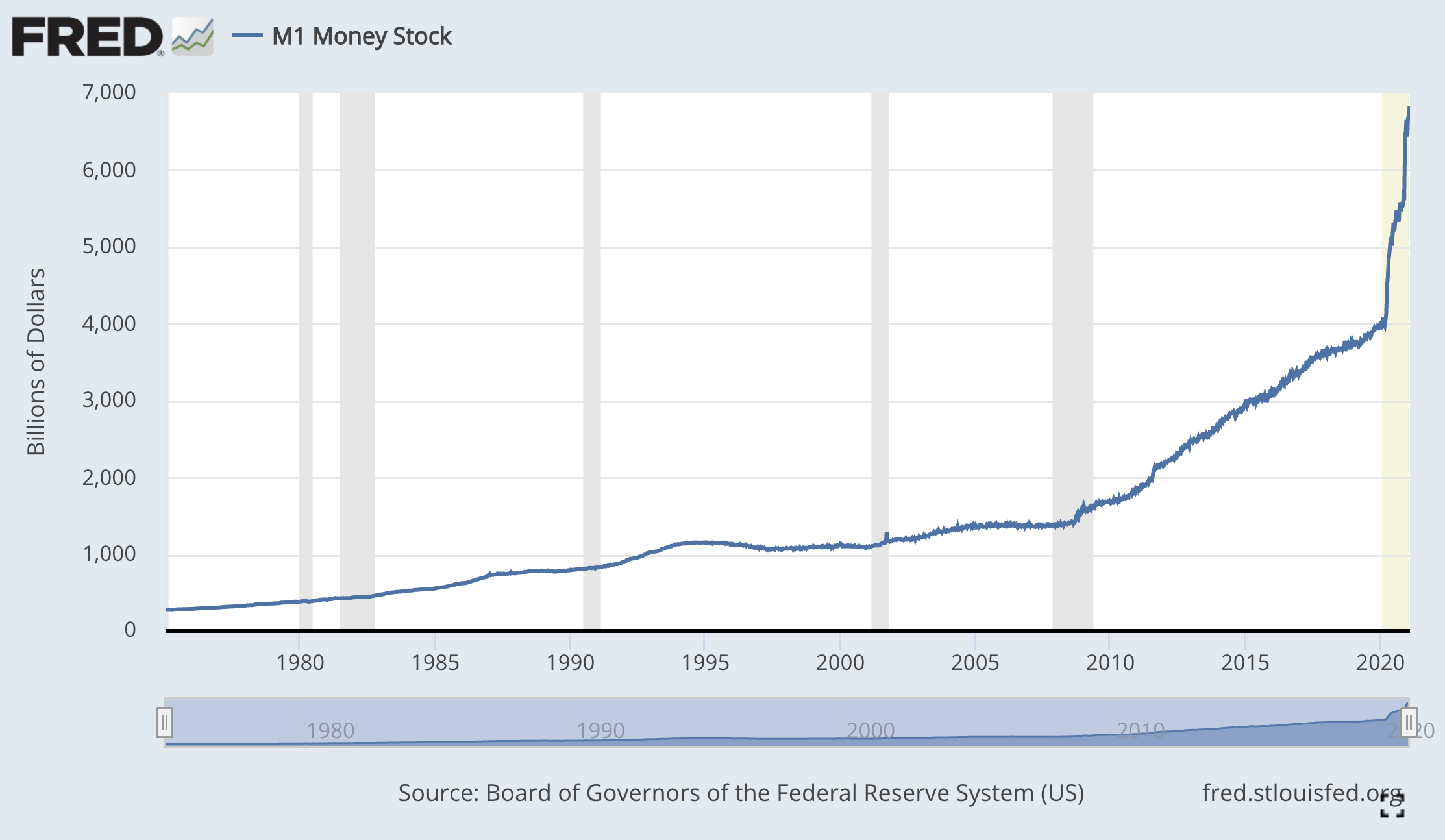

This week I kept looking at the M1 money supply chart on the Fed's website:

M1 roughly means the U.S.-dollar money supply consisting of physical currency and what's in bank accounts. There's a few more measurements like M2 and MB, which is the total Monetary Base, e.g. all the U.S.-dollars in existence.

Quantitative Easing

As you see, since the 2008 Financial Crisis the supply has grown a lot, this means the Fed has essentially printed money and injected it into the economy (usually by investing in the markets).

This is called Quantitative Easing (QE) and is a way to keep economies afloat if they go through bad times.

COVID money printing

Since the COVID19 pandemic started, the printing has gone to a whole different level though. The M1 money supply has almost doubled since. What that means for inflation is heavily argued about by different sides. The economists say it's fine. The intelligentiae, libertarian and crypto people say this is causing inflation (your money becomes worth less).

Did my stocks actually go up?

Thinking about this I wondered if my stock and ETF investments actually went up this year. Or was it just the printing of money and actually the numbers went up but the intrinsic value stayed the same?

Let's find the data

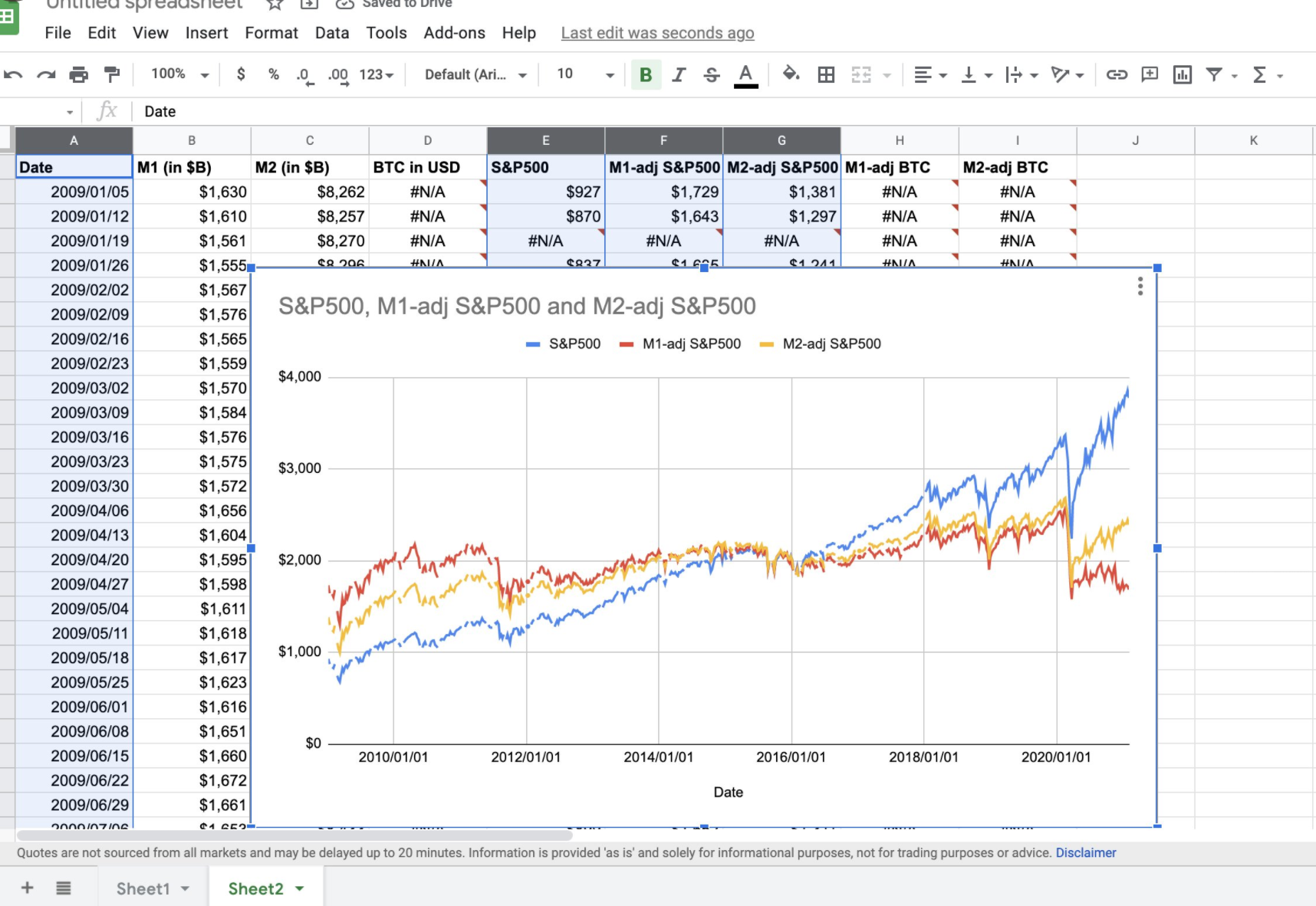

I downloaded the data from the Fed and put it in a Google Sheet:

And make a site

Then I made a site around it called M1chart.com (and now renamed it to InflationChart.com). It imports the data from the sheet into a SQLite db and puts the data in a ChartJS page. I made it very simple inspired by Stonks in BTC.

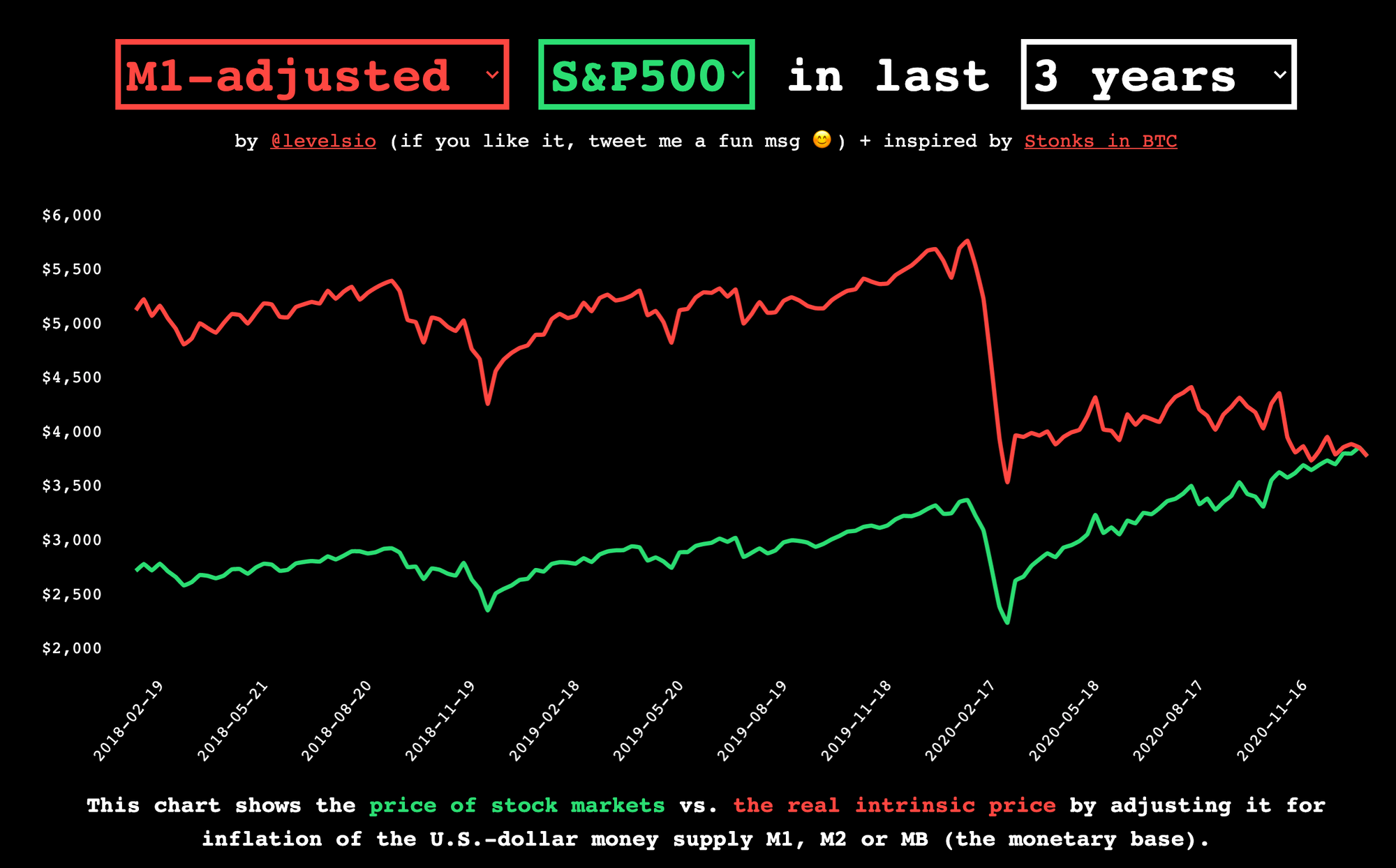

The top boxes are select boxes and you can adjust what you want to see and it live updates. You can choose between M1, M2, MB and adjust the S&P500, the Dow Jones DJI, etc. and adjust the length of time the chart goes back.

The visual above is already quite telling, if you adjust for M1 (the red line) the markets have crashed early 2020 when COVID hit. Then they didn't recover. Instead we're almost at the lowest point since the pandemic started.

There's lots of caveats to this project. M1 is a limited measure as it only includes physical money and bank accounts. So I've also added M2, MB etc. Even with those you can see the effect though.

Launch to HN

I submitted it to HN and it went to the front page:

The reactions

As always HN'ers had were very opinionated. Two of the top comments are interesting:

and my favorite:

Wealth inequality

My conclusion is, adjusting the stock market for the money supply doesn't tell the whole story, but it does tell that there's a lot of money printing going on and if that continues we're probably making a lot of people poorer. But it's complicated matter so we're not sure.

By investing in the stock markets, even if there's lots of inflation, at least my money stays the same value. Many people who don't have access to, or the knowledge or time to invest in the stock market and they'll feel the biggest negative effects from inflation. And that's probably people who are already rekt. So it probably increases wealth inequality.

What can we do about that?

Well, we should probably educate people about inflation with projects like these and help them invest in long term diversified portfolios so their money stays the same value or grows in value. Like ETF index funds. And maybe 5% of BTC/ETH/crypto.

We should also argue for having people's income/salary be adjusted for real inflation numbers (e.g. 10% per year), instead of the government's Consumer Price Index based inflation (e.g. 2% per year) that doesn't tell the whole story.

What can I do about it?

I like to have skin in the game so I've gone ahead and will give my contractors for Nomad List and Remote OK a minimum of 10% per year increase in income, starting with this month.

P.S. I'm on Twitter too if you'd like to follow more of my stories. And I wrote a book called MAKE about building startups without funding. See a list of my stories or contact me. To get an alert when I write a new blog post, you can subscribe below: